How to Invest Successfully in an Uncertain World

The Most Adaptable to Change

Charles Darwin was a British naturalist and biologist who, in his 1859 work ‘On the Origin of Species’, proposed his theory of evolutionary biology which is now considered a foundational concept in modern science. He developed the concept that the ability of animal species to adapt to a changing world facilitated their continued existence and ability to thrive. This was a groundbreaking idea and one which has passed the test of time. The ability to adapt to change is critical to survival in the animal kingdom. The world is constantly changing, this is a core characteristic of the universe we live in. In a world of constant change, the difference between animal species with a high versus low adaptability is the difference between success and extinction.

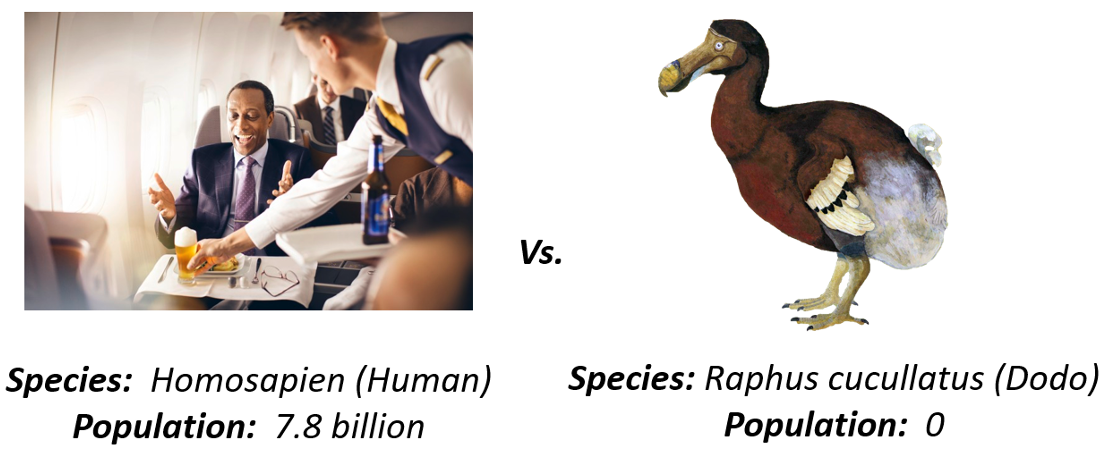

Let’s take a real example of a comparison between two species and look at their relative success and failure over time.

Homo sapiens are an intelligent and highly adaptable species of primate that has come to dominate the Earth (a species otherwise known as ‘humans’). Raphus cucullatus (the ‘Dodo’) was a species of flightless bird found on islands in the Indian Ocean. Because the Dodo had spent long periods of time on islands with no natural predators, the species had lost its natural fear of other animals and as such was quickly hunted to extinction by the 19th century. The Dodo was an animal species with a low ability to adapt, while Homo sapiens are distinguished by their high ability to adapt.

The vast difference between the outcomes of the two species discussed in the previous example provides an important lesson for investors to think about. The ability to adapt as a core characteristic in the animal kingdom, over a long period, is the difference between a species building mega-cities (humans) and a species that no longer even exists (the Dodo).

As much as the natural world is characterized by constant flux and volatility, so too is the economic world. The political, social and technological structure of our society is constantly in a state of change and development, it is never static. Much like the ever changing natural world, this creates an economic environment where today’s business success stories may look a lot like the Dodo in the future. The ability of businesses to adapt to change is as fundamental to their success or failure as it is to the prosperity or extinction of a species in the animal kingdom.

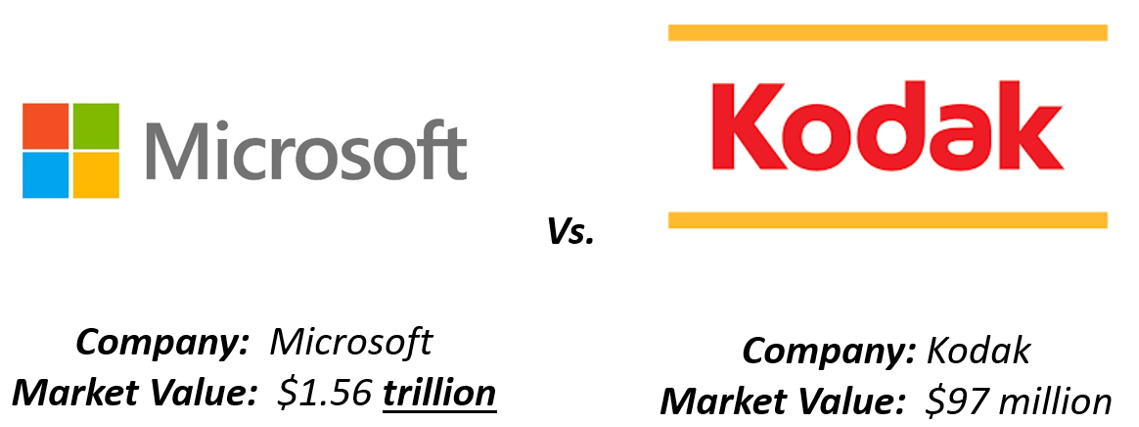

History provides us with many examples of this pattern. The Eastman Kodak Company (‘Kodak’) and Microsoft Corporation offer us a comparable story of the importance of adaptability in the business world to success or failure. Can you guess which of these two businesses is the ‘Dodo’?

For much of the 20th century, Kodak was the dominant player in the photographic film industry. Before the days of digital photography and mass adoption of personal computing, photographic film was the primary medium used to store and share images. This made Kodak one of the 20th century’s business success stories and a core stock holding for many investors at the time. Kodak even developed the first digital camera, anticipating and even developing the disruptive technology that would fundamentally change its industry. But Kodak as a business was unable to adapt to change and this is reflected in the dramatic decline in its market value which culminated in declaring bankruptcy in September 2013.

Microsoft Corporation plays Homo sapiens in our business world example of adapting for success. The company was founded in 1975 (Microsoft is already approaching its half-century!) and has evolved from initially being a basic software business, to developing operating systems for personal computers, moving into computer gaming in the 1990-2000s and other hardware, and is today one of the leading cloud computing service providers. Microsoft is a business with a high level of innate adaptability which has allowed it to prosper and continue to grow in a changing world. Today, the company has a market value of more than $1.5 trillion.

The lesson for investors to takeaway from this is clear. The ability to adapt is core to success, in both the natural world and the business world. For investors looking for long-term success, they must have exposure to investment strategies that take adapting to a changing world seriously. Otherwise, they risk being like the Dodo or Kodak.

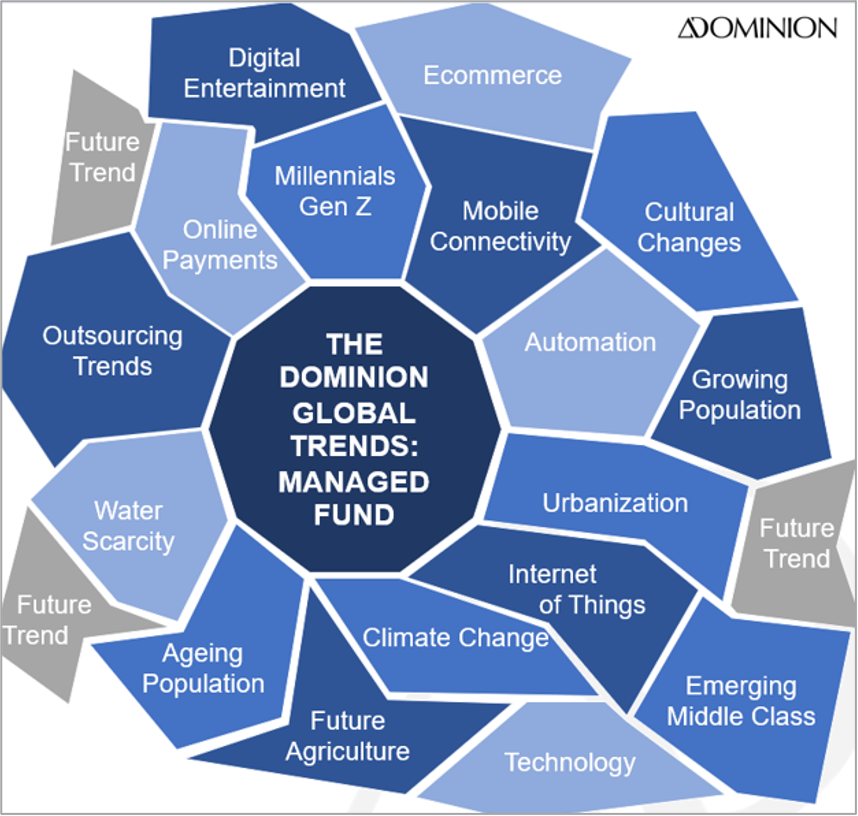

The Managed Fund: Designed to be Adaptable to a Changing World

This September marks the 8th anniversary of the Dominion Global Trends: Managed Fund. The Fund is Dominion’s core, multi-sector global investment fund, employing our strategy of investing in high quality, structural growth businesses across multiple Global Trends.

Core to the strategy of the Fund and its continued success is the ability of the Fund to adapt. We live in a world that is constantly changing and at Dominion we have aligned the Fund’s investment exposure to be invested in the major sources of change in the global economy. Further, we have structured the Fund to keep track of ‘Future Trends’, those trends which are not yet investable but will, at some point in the future, be important drivers of change in the world economy.

The Managed Fund is structured to adapt over time to a changing world

A changing world creates great opportunities for investors, and this is the focus of the Fund.

The world’s population is ageing. By 2050, there will be 2.1 billion people over the age of 60, which will create massive new demand for healthcare treatments for illnesses experienced in older age. The market for medical research will be more than $200 billion per year by 2024. The Managed Fund is exposed to this trend through its investments in medical research service providers, which benefit from the steady rise in demand for research and development into new drugs and treatments of the future.

Technology used in transportation is fundamentally changing. The days of the internal combustion engine are numbered and electric vehicles will power the future of local and regional travel. Global demand is currently 2.1 million electric vehicles per year, which is expected to rise to 100 million per year by 2030. This is a +5,000% increase in market size over the next decade and the Managed Fund is invested in this trend for the long-term.

The way humans and machines communicate is changing. Billions of people and tens of billions of devices will be connected to the internet in coming years. As the cost of connecting people and devices wirelessly has come down dramatically, this has opened up new possibilities to connect the world around us to the web. The Managed Fund is invested in this trend through its exposure to the hardware manufacturers who supply the critical connection components that facilitate this trend, as well as the cloud computing companies that build and own the back-bone of the modern internet.

These trends and many more are core to the Fund’s strategy. The Fund invests for the long-term in the companies whose technology and business models facilitate the fundamental changes occurring in the world around us. The ability of the Fund to adapt over time, shifting its exposures into new trends as they emerge, provides investors with a strategy which is always aligned with the biggest growth opportunities in the global economy.

To Infinity... And Beyond!!!

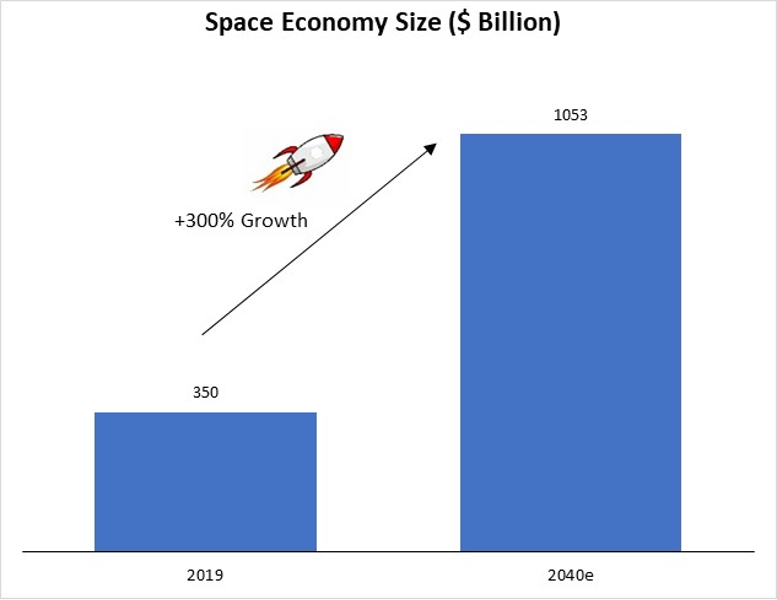

Humans have been active in space since the 1950s, but it is only in the past 30 years that human economic activity in space has taken-off (pardon the pun). Today the space economy is worth $350 billion per year, with much of this being near earth orbit satellites (primarily used for communication and Earth observation) and launch vehicles to get those satellites into orbit.

But things are changing in the space economy. The cost of accessing space is coming down, dramatically. Private investment in the space launch industry has increased rapidly over the past decade and this has spurred rapid innovation in new technologies to reduce the cost of getting people and equipment into space. This trend is opening up potential for human activity and the human economy to expand rapidly into space. This is no sci-fi fantasy. We are truly in the early stages of a new phase of human development where the space economy will become a major factor in overall human activity. We may even one day have to stop talking about the ‘World Economy’ and start talking about the ‘Solar System Economy’.

Current industry forecasts expect the total value of the space economy to reach more than $1 trillion by the year 2040. At Dominion, we think these estimates could be too conservative. If the cost of accessing space continues to fall, the space economy could, we think, be multiple trillions in value by the 2030s.

Beam us up! The space economy could be a major driver of investor returns in the future

At Dominion we class the space economy as a ‘Future Trend’, a trend we research in depth and will invest in when the trend starts to offer the opportunities to generate long-term returns for our investors. This is an example of the Fund adapting over time. When the Fund was launched 8 years ago, the space economy was not a trend with much opportunity in which to invest, it was still too immature. Today, we stand at the inflection point of a trend which will last decades, facilitated by new technology in the space launch industry which offers investors a long-term investment exposure which will generate strong returns.

As the world changes, so does our Fund exposure. Our Fund adapts over time to remain invested, over the long term, in the biggest sources of change in the world economy. This ability to adapt is core to the success of the investment strategy, a strategy we believe investors cannot afford to miss.

From Darwin to Space Travel... and Beyond!!!!